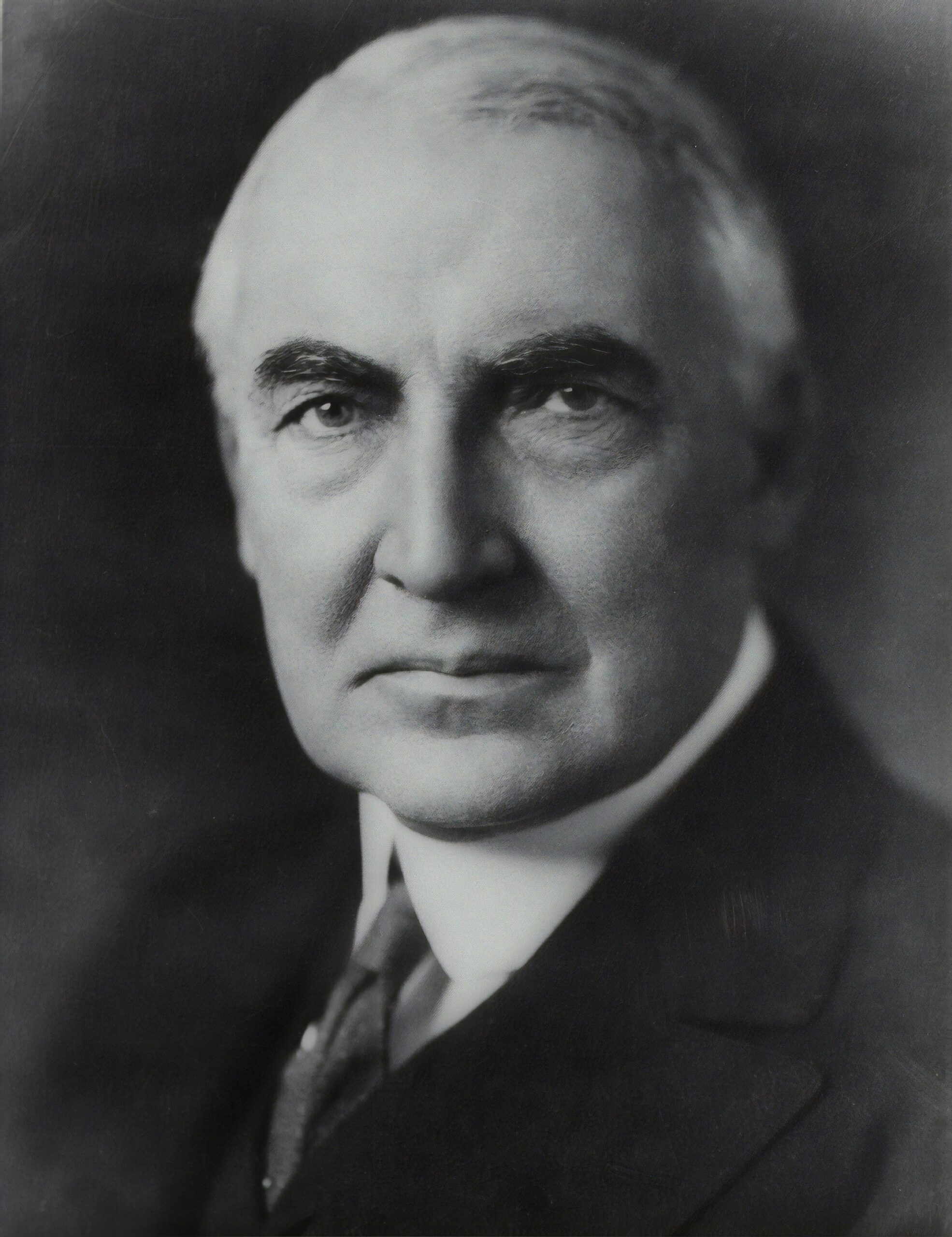

Warren Buffett, the 40-year-old billionaire investor, is widely regarded as one of the most successful investors of all time. With his incredible track record and vast wealth, it’s no wonder that many people look to him for investment advice. In this blog post, we will explore nine investment tips from Warren Buffett that can help you make smarter investment decisions.

1. Invest in What You Understand

One of Buffett’s key principles is to invest in companies and industries that you understand. Avoid investing in businesses or assets that are outside of your circle of competence. By sticking to what you know, you can make more informed investment decisions and avoid unnecessary risks.

2. Focus on the Long Term

Buffett is known for his long-term investment approach. He believes in buying and holding onto quality stocks for the long haul. Instead of trying to time the market or make quick profits, focus on the long-term potential of your investments. This strategy can help you ride out short-term market fluctuations and benefit from the compounding effect over time.

3. Buy Stocks at a Discount

Buffett famously said, “Price is what you pay, value is what you get.” Look for stocks that are undervalued or trading at a discount to their intrinsic value. By buying stocks at a discount, you increase your potential for higher returns when the market recognizes the true value of the company.

4. Diversify Your Portfolio

While Buffett is known for his concentrated bets on a few key stocks, he still emphasizes the importance of diversification. Diversifying your portfolio across different asset classes and industries can help reduce risk and protect your investments from unforeseen events.

5. Be Patient

Patience is a virtue when it comes to investing. Buffett advises investors to be patient and wait for the right opportunities to come along. Avoid making impulsive investment decisions based on short-term market trends or emotions. Take the time to thoroughly research and analyze potential investments before committing your capital.

6. Don’t Try to Time the Market

Buffett advises against trying to time the market. Instead of trying to predict short-term market movements, focus on finding quality companies at attractive prices. Trying to time the market can be a risky and futile exercise, even for seasoned investors.

7. Invest in Yourself

Buffett believes that investing in yourself is one of the best investments you can make. Continuously learn and improve your skills and knowledge about investing. The more you know, the better equipped you will be to make sound investment decisions.

8. Be Fearful When Others Are Greedy, and Greedy When Others Are Fearful

This famous quote from Buffett highlights the importance of contrarian investing. When everyone is buying and the market is euphoric, it may be a good time to be cautious. Conversely, when everyone is selling and the market is in panic mode, it may be an opportunity to find bargains.

9. Surround Yourself with the Right People

Buffett attributes much of his success to the people he surrounds himself with. Find mentors, advisors, and like-minded investors who can help guide and support you on your investment journey. Surrounding yourself with the right people can provide valuable insights and help you avoid costly mistakes.

In conclusion, Warren Buffett’s investment tips can serve as valuable guidance for investors looking to achieve long-term success. By investing in what you understand, focusing on the long term, buying stocks at a discount, diversifying your portfolio, being patient, avoiding market timing, investing in yourself, being contrarian, and surrounding yourself with the right people, you can increase your chances of making wise investment decisions. Remember, investing is a journey, and it’s important to continuously learn and adapt as you navigate the ever-changing financial landscape.

Leave a Reply